About 3000 BC, the northern Chinese used a form of cement in boat-building and in building the Great Wall. A key ingredient in the mortar used in the Great Wall was glutenous, sticky rice, and some of these structures have resisted even modern efforts at demolition. – The History of Concrete

As for steel, The first famous metallurgist in ancient China was Qiwu Huaiwen of the Northern Wei Dynasty (386-557 AD), who invented the process of using wrought iron and cast iron to make steel. – china.org.cn

Once steel is produced it becomes a permanent resource for society – as long as it is recovered at the end of each product life cycle – because it is 100% recyclable without loss of quality and has a potentially endless life cycle. Its combination of strength, recyclability, availability, versatility and affordability makes steel unique. – worldsteel.org

In 1980 when China first opened its doors to world trade, it produced 37.1 million metric tons of modern crude steel–5.17% of global production that year. For a comparison, the U.S. produced 101.4 million metric tons, Japan produced 111.4 million, and the European Union produced 208 million metric tons.

Thirty-four years later in 2014, China’s share of global crude steel product reached 49.1% or 822.698 million metric tons to the 88.174 million metric tons produced in the United States that year.

What caused this dramatic change? The answer is easy, the growth of China’s middle class. China has more than four times the population of the United States and almost twice the population of Europe.

And that’s why Business Insider says, “China’s rising middle class will create opportunism the world has never seen before.”

About 30 years ago, China started to modernize and in those thirty years, it has achieved what it took Europe and the North America more than two hundred years. China’s goal is to end up with the same urban to rural population ratio found in Europe and North America, and it is nearing that goal. Imagine compressing more than two hundred years of pollution from the West’s industrial revolution into thirty years in China.

To understand this spectacle, in 2004 the BBC News reported that, “The biggest mass migration in the history of the world is under way in China, and it is creating what some are calling the second industrial revolution.… A massive building boom unparalleled anywhere is taking place – last year, half the concrete used in construction around the world was poured into China’s cities.”

Concrete isn’t the only product China needs. Iron and steel are also necessary.

China hunger for iron has been epic. In 2009, India exported 106 million tons of iron to China. A July 2010 Reuters piece says, “Chinese steel producers are increasingly turning to Australia’s magnetite iron ore sector, pouring in funds to explore and develop mines once considered uneconomic…”

In 2006, China was the number one producer with 820 million metric tons of iron ore and still imported 52% from other countries like Australia (470 metric tons), India (150) and Brazil (250). Source: Wikipedia

Now that China is nearing its goal—in about 15 years China’s middle class will outnumber the entire population of the United States—it has an excess of steel and is exporting that excess at lower prices to other countries creating stiff competition across the globe. For instance, the ISSB reports that from 2013 to 2014 China increased its steel exports by 53% from 57.9 million to 88.6 million tonnes while the United States saw a 5% drop in its steel exports.

With the United States so obsessed to be #1 in everything—except for reducing the poverty rate—its capitalist oligarchs must be obsessively stressed out and worried that they are going to lose their Imperial crowns.

______________________________

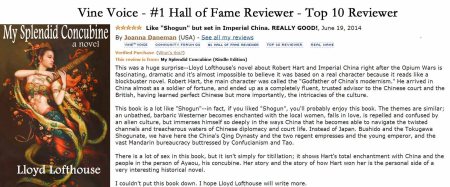

Lloyd Lofthouse is the award-winning author of My Splendid Concubine [3rd edition]. When you love a Chinese woman, you marry her family and culture too. This is the lusty love story Sir Robert Hart did not want the world to discover.

Subscribe to “iLook China”!

Sign up for an E-mail Subscription at the top of this page, or click on the “Following” tab in the WordPress toolbar at the top of the screen.

Posted by Lloyd Lofthouse

Posted by Lloyd Lofthouse